Turkey has implemented various incentive and investment programs and provided tax advantages to support startups; however, most of the tech startups aim to incorporate in the United States. The motivations behind this tendency are several, but one of the common mechanisms that serve this purpose is the “flip up” process, which allows entrepreneurs to move their businesses to other countries, especially the United States. In this blog, we will focus on what the “flip up” really means to entrepreneurs, the main principles behind this process, and what purposes “flip up” serves.

- Definition

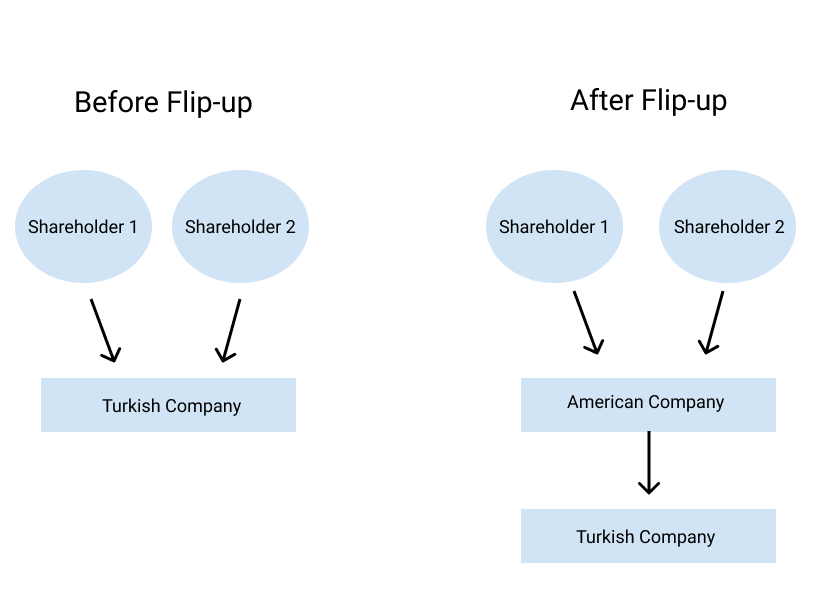

In general terms, “flip up” refers to all transactions regarding transfer of the shares of a company (the “HomeCo”) incorporated in one country (for example, Turkey) to a company (the “TopCo”) to be incorporated or acquired in another country (for example, the United States) in exchange for the shareholders of the HomeCo to contribute the TopCo with the same shareholding structure. For instance, all transactions with respect to the shareholders of a Turkish company becoming the shareholders of an American company by preserving the same shareholding structure and transferring all shares of the Turkish company to the American company is considered as “flip up”. In such a case, the Turkish company becomes the wholly owned subsidiary of the American company, while the American one will be the parent company. It is worth to note that companies may also undertake the “reverse flip up” processes occasionally, depending on the needs of relevant company.

- Reasoning Behind Flipping Up

There are various reasons to realize “flip up” in practice, the most common of which are to attract the international investors and accelerator programs, get into the American or international markets where customers or target audiences are located, obtain an investor visa or have a chance to go public in international stock markets, but the reasons are not limited with thereof. Undoubtedly, the main motivation is to receive investment from international angel investors and venture capitals, since the investors usually prefer the startups incorporated in the locations where they are familiar with both the legal regulations and approach of the judicial authorities in case of dispute, rather than the startups incorporated in other countries whose legislation and commercial customs are unpredictable for them.

At this point, it is crucial to address the income tax exemption that makes “flip up” transactions more attractive for Turkish companies and their employees. Pursuant to Article 23 of the Revenue Tax Law numbered 193, remunerations paid by the employers whose registered and business offices are not located in Turkey and who are subject to limited tax liability, to the employees in foreign currency over the income earned outside of Turkey, are exempted from income tax. There is no doubt that the companies are encouraged to receive tax-related consultancy services and to evaluate whether the structure of the startup is suitable for such an exemption in that present case, in order to benefit from the exemption without bearing any risks of sanction.

- Where to Flip Up

As a result of the foregoing reasons, companies to be incorporated abroad within the scope of “flip up” process are generally located in the State of Delaware, United States. Indeed, Delaware offers predictability and certainty for both entrepreneurs and investors, even in complex transactions, considering many venture capital and tech companies are based in Delaware, and it has comprehensive and well-regarded corporate legislation and established precedents, provides many regulations to protect shareholder rights, resolves disputes before the courts in a relatively short time, and offers complete confidentiality to investors who do not want to be disclosed. In addition, the entrepreneurs who plan to go public with less expense and paperwork have also been attracted the fact that the largest stock exchanges around the world (such as NASDAQ) are located in the United States. Last but not least, the lack of a work permit, citizenship, or visa requirement to incorporate a company in the United States also appeals to startups. (1)

Companies choosing the United States to receive investments or go public, prefer the C-Corporation (C-Corp) structure, which has many elements similar to the joint-stock companies in Turkey. Thus, they can offer their employees the opportunity to contribute to the company through share option plans. In any case, it is significant to evaluate the country to be targeted abroad and the type of company to be incorporated based on the characteristics of each startup and project, from legal and tax-wise aspects. Even it is rare, it may be advantageous to incorporate in other destinations such as Singapore, Portugal, Hong Kong, the United Kingdom, or Estonia if the circumstances require. (2)

- How to Flip Up

To summarize, the “flip up” process consists of three steps in general, which have complex legal and tax-wise dynamics:

- First of all, it is important to execute a share exchange agreement between the company to be incorporated abroad and the shareholders whose share ratio will be preserved and reflected in the shareholding structure of such company, and to carry out all preliminary works to incorporate abroad under supervision of the professionals.

- Secondly, all incorporation transactions of the company to which the shareholding structure will be reflected abroad, are completed.

- Lastly, all necessary share transfers and post-incorporation transactions are carried out in order to reflect the shareholding structure of the first company to the company incorporated abroad and such company to be the sole shareholder of the first company.

When the foregoing transactions are completed, the dominance of the existing shareholders over the first company will be preserved indirectly and all shares of the first company becomes the sole asset of the company incorporated abroad.

It is important to transfer existing shareholding structure to the company to be incorporated identically; to annul existing shareholder agreement between the shareholders in Turkey, and to draft new one for the company incorporated abroad by taking into account the law (usually Delaware) to which such company is subject; to execute further agreements between the shareholders in case it is not desired to transfer certain privileges currently granted to the shareholders to the company to be incorporated or it is not possible to transfer thereof in accordance with the relevant legislation; and to reflect the existing share option plans adopted in favor of the employees to the new company as much as possible.

In practice, startups may prefer to keep passive the company incorporated abroad and to carry out all transactions (especially R&D activities) through the first company. However, the new company can also operate actively by taking over or licensing the intellectual property rights and know-how of the first company, both for meeting the requirements of the investors and for operational convenience. It is important to get the assistance of experts in the preparation of the necessary contracts and conducting registration processes.

- Timeline of Flip Up

Completion of the “flip up” process can extend over a long time depending on many factors, such as complexity of the shareholding structure of the Turkish company, volume of transactions, the nature and value of its assets. For example, transferring the shareholding structure of companies with many shareholders, assets, and complex transactions such as convertible bonds in the balance sheet, is becoming difficult, the process takes longer, and the costs increase. (3) In this regard, completing the “flip up” process at the very beginning of the startup’s journey, ensures the process to be completed much faster and with less expense due to the simplicity of the shareholding structure and the absence of assets in the company. In addition, investors’ request to examine the “flip up” documents is among the factors that may prolong the process.

Conclusion

When determining whether a startup needs to “flip up“, various factors such as involvement in the investment process or nature of the activities should be taken into account, as conducting an unnecessary “flip up” process both takes time of the entrepreneur and creates a financial burden on the company in terms of establishment, transfer and consultant costs. The “flip up” process and the transfer of intellectual property rights afterward may require complex legal and tax-wise procedures. Furthermore, before starting the “flip up” transactions, it is important to review the contracts to which the Turkish company is a party and to carry out notification and approval processes to be made due to the “flip up“. Otherwise, other party of the contract may be entitled to terminate the agreement, claim compensation, or even a penalty if it is expressly stipulated. For this reason, it is highly recommended these processes be carried out by the legal and tax consultants who are familiar with the local legislations and regulations of the country the company will be incorporated abroad.

- https://www.jdsupra.com/legalnews/flipping-your-business-into-the-united-4658631/ (Last Accessed on 28/02/2022); https://startuphukuku.com/amerika-ruyasi-startupinizi-abdye-tasimak-flip-up/ (Last Accessed on 28/02/2022).

- https://www.alliedlegal.com.au/blog/moving-overseas-the-a-b-cs-of-flip-ups/ (Last Accessed on 28/02/2022).

- https://blackbird.vc/blog/flip-ups-not-as-scary-as-you-think (Last Accessed on 28/02/2022).